In response to draft regulations 400 CMR 8.00, “Cannabis Social Equity Trust Fund” issued by the Executive Office of Economic Development, Equitable Opportunities Now issued the following public comments.

Public Comments Submitted by EON to EOED on Jan. 12, 2024

January 12, 2024

Robert McGovern

Executive Office of Economic Development

1 Ashburton Place, Room 2101

Boston, MA 02108

Sent via email to Robert.McGovern@mass.gov

RE: Public comments regarding 400 CMR 8.00, “Cannabis Social Equity Trust Fund”

Dear Mr. McGovern and Whomever It May Concern,

On behalf of Equitable Opportunities Now (EON) and our supporters and partners across the Commonwealth, we are writing to thank you, your team at the Executive Office of Economic Development (EOED), and the Cannabis Social Equity Advisory Board (CSEAB) for the significant work you have undertaken to craft draft regulations 400 CMR 8.00 (the Regulations) implementing Section 14A of Mass. General Laws Chapter 94G to establish and administer the new Cannabis Social Equity Trust Fund (CSETF or “the Fund”).

We particularly appreciate the work that you and Gov. Maura Healey’s Administration undertook to create and pass a legislative fix to the delays that have persisted since the passage of Chapter 180 of the Acts of 2022 (Ch. 180). We further appreciate how accessible Assistant Secretary Vega, CSEAB members, and your team have been and your receptiveness to ongoing feedback. We are especially grateful to Assistant Secretary Vega for joining EON and our supporters for our Celebration of Equity Champions on Dec. 19 where he shared updates on the program and spent hours getting to know us and our industry.

As you are likely aware, the Fund and these regulations are a long time coming. Social justice was a core tenant of Question 4 when voters passed it in 2016, the Legislature determined that excess cannabis revenue should support restorative justice in 2017[1], yet it has taken more than five years since the first adult use dispensaries opened to provide this critical source of capital to cannabis Social Equity Businesses. We thank you for your efforts to craft thoughtful regulations and move this fund forward as quickly and equitably as possible.

While we have several concerns and suggestions detailed below, we want to thank you for your efforts to create a regulatory framework that attempts to be as simple and straightforward as possible. We further thank you again for your receptivity to continuous feedback and improvement in the administration of this program.

As you revise and finalize these regulations, we urge you to build on the progress of this draft by making the following improvements:

- Ensure that EOED is not creating unnecessarily burdensome restrictions that prevent Social Equity Business owners from being able to sell their business without penalty

- Ensure access to this program for applicants who have not participated in the Cannabis Control Commission’s (CCC) Economic Empowerment prioritization status or Social Equity Program but who are 51+% owned by people eligible for those programs

- Prioritize Social Equity Businesses who most need these funds while also recognizing that all applicants and operators are struggling for working capital in this market and seeking to meet as much need as possible

- Issue grants and loans that will have meaningful impacts by offering large awards up to between $500,000 to $1.5 million to those who need it while also preserving funds to provide support to those with more modest financial needs

- Do not ask struggling businesses to pay money before they are able to access these funds by waiving application fees

- Prioritize grants over loans

- Focus on struggling businesses before providing funds to municipalities and set reasonable limits on funds to municipalities

- Align EOED deadlines for letters of good standing with CCC’s 90-day deadline for submitting such letters

- Clarify that EOED will advertise the program to diverse audiences

- Add regulatory language to ensure data collection, evaluation, and transparency

Revise overly burdensome restrictions on sale of equity licenses

Section 14A(c) of MGL Chapter 94G authorizes EOED, in consultation with the CSEAB, to:

“…promulgate regulations governing the structure and administration of the fund, including, but not limited to… prohibitions against the sale, transfer or pledge of any asset or interest by a social equity business to an entity or individual other than a social equity business or an individual qualified as an economic empowerment priority applicant as defined by the commission’s regulations within an initial, specified timeframe to begin on the date the business is authorized to commence operations by the commission; provided, however, that the initial, specified timeframe shall not exceed 5 years.” (emphasis added)

Although this statutory language creates a five-year cap on how long EOED may prohibit the sale of equity licenses to non-equity entities, it does not establish a statutory minimum length of time for that period.

While we recognize the Legislature and EOED’s policy interest in ensuring that individuals and communities disproportionately impacted by the war on drugs are the beneficiaries of these funds, it is critical that EOED balance that concern against the very real and immediate needs of those individuals and communities.

Aside from EOED’s authorization to set limits on license sales to equity businesses who receive grants and loans, there are no other legal or regulatory restrictions on the ability of Social Equity Business licensees from selling their licenses to non-equity entities. While Economic Empowerment (EE) applicants and Social Equity Program (SEP) participants benefit from the CCC’s prioritization and other state and municipal programs relative to their EE or SEP status, the Commission does not limit those owners’ ability to sell their license within after taking advantage of those benefits. Nor should they.

The fact that voters and legislators agreed that those most harmed by the war on drugs should be able to start businesses, create jobs, and generate wealth in this new industry does not mean that those who enter this industry should be forced to remain within it by government mandate. Whether an applicant or operator wants to sell a business for profit while its performance is strong or wants to unload a business that’s continuing to struggle despite their best efforts, the government should not play a role in interceding in that decision.

The CSETF was established to support businesses that have less access to capital and are inherently disadvantaged and struggling in this market. While it is our hope that many of the grants and loans issued by the Fund will help businesses to succeed and thrive, it is reasonable to expect that not every business will succeed despite the assistance. It would not be equitable for EOED to tell an owner that they need to keep their struggling business for three to five years or face clawbacks.

While Ch. 94G Section 14A(c) requires that the prohibition on sales or transfers not exceed five years after receipt of funds, there is nothing in that language that prohibits EOED from using more reasonable benchmarks.

Based on initial feedback from applicants and operators, we urge EOED to update 400 CMR 8.07(a) to:

“(1) A person or entity who expends any amount of Financial Assistance to acquire a Restricted Asset shall not sell, convey, transfer or pledge such Restricted Asset, nor any interest in the entity that owns such Restricted Asset, except if such sale, conveyance, transfer or pledge is to or for the benefit of a Social Equity Business or an Economic Empowerment Priority Applicant. Such restrictions shall expire on the fifth shall be fewer than five years, but in no event shall the restriction period be fewer than three years

As EOED continues to evaluate and improve this program, we urge staff and the CSEAB to hold further discussions with stakeholders on these limits.

Furthermore, to ensure that a program that intends to support equitable economic opportunity does not have the opposite effect, we urge you to add the following fourth section to 400 CMR 8.07:

“(4) EOED will create a hardship waiver application by which a person or entity who expends any amount of Financial Assistance may request (a) an exemption from the terms of their contract prohibiting the sale of their license or (b) exemption from penalties detailed in 400 CMR 8.07(2) and 8.07(3).”

Clarify eligibility requirements to ensure all eligible applicants can apply

Chapter 180 of the Acts of 2022 defines a Social Equity Business as “a marijuana establishment with not less than 51 per cent majority ownership of individuals who are eligible for the social equity program under section 22 or whose ownership qualifies it as an economic empowerment priority applicant as defined by the commission’s regulations promulgated pursuant to section 4.”

It was encouraging that EOED’s definition defines these businesses per 400 CMR 8.02 in line with the definition provided by statute:

“Social Equity Business. A Marijuana Establishment with not less than 51 per cent majority ownership of individuals who are eligible for the social equity program or whose ownership qualifies it as an Economic Empowerment Priority Applicant, as defined by Section 1 of Chapter 94G of the General Laws. For purposes of administering the Fund, EOED may rely on the Commission’s verification of an entity as a Social Equity Business.”

However, we are deeply concerned that the addition of the final sentence in EOED’s definition of Social Equity Business could lead to delays and the exclusion of otherwise eligible Social Equity Businesses.

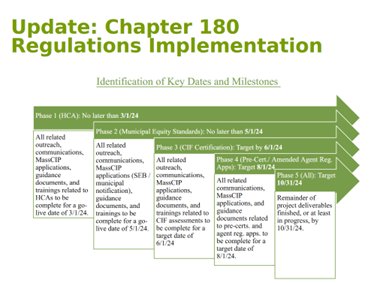

As you are likely aware, the Cannabis Control Commission promulgated regulations related to Ch. 180 in November and recently released a timeline on its implementation of those regulations. Due to time-sensitive municipal deadlines coming up in March and May, it could take until August, or even longer, for the Commission to have a process by which to verify entities as Social Equity Businesses.

While applicants and the CCC can easily verify EE applicants or SEP participation, there is no comprehensive list of all entities that would be eligible for those programs but who have not participated in them.

To ensure that this program is available to every eligible Social Equity Businesses, we urge you to clarify the definition of Social Equity Business in 400 CMR 8.02 as follows:

“Social Equity Business. A Marijuana Establishment with not less than 51 per cent majority ownership of individuals who are eligible for the social equity program or whose ownership qualifies it as an Economic Empowerment Priority Applicant, as defined by Section 1 of Chapter 94G of the General Laws. For purposes of administering the Fund, EOED may rely on the Commission’s verification of an entity as a Social Equity Business, an attestation by the applicant verifying status as a Social Equity Business, or documented participation in a municipal equity program deemed to have equivalent or more restrictive eligibility criteria than the Commission’s Economic Empowerment Priority Applicant status and Social Equity Program.”

Maximize the impact of the Cannabis Social Equity Trust Fund

In addition to ensuring the program is accessible to all eligible applicants and removing overly prescriptive mandates on recipients, there are several opportunities for ensuring this program does the greatest amount of good for the most applicants.

Prioritize Businesses in Need

While we recognize that legislators included the possibility of providing CSETF funds to municipalities, we urge EOED focus on meeting the significant needs of operators and applicants struggling to gain a foothold in this industry before it is completely saturated by large out of state operators.

As such, we urge EOED to incorporate into its regulations and/or establish subregulatory guidance that clarifies that:

- EOED will dedicate all or at least 95% of funds available to Social Equity BusinessesEOED will make grants and loans in a variety of sizes (including large awards between $500,000 to $1.5M) to best meet the needs of applicants and stabilize the participation of Social Equity Businesses in the industry

- EOED will prioritize the issuance of grants over loans and create a process with CSEAB and stakeholders for determining the appropriate balance of grants and loans in the future

- EOED will not issue grants or loans to municipalities until after all exclusivity periods for equity businesses have expired and/or certain metrics to be determined by EOED, CSEAB, and stakeholders demonstrates significant process toward equitable participation in the industry

- EOED will establish a process with CSEAB and stakeholders to determine when, how much, and with what restrictions any grants or loans will be made to municipalities

- EOED will establish reasonable caps on how much CSETF funding can be spent by municipalities toward administration and operations and how much should be dedicated toward pass-through grants and technical assistance

Waive fees for struggling businesses

EOED will require resources to support the administration of the CSETF, review applications, contract with administrators, and otherwise implement this program. However, we should not ask already struggling and cash-strapped businesses to provide the resources to administer the program that provides them with critically needed grants and loans.

We urge EOED to strike 400 CMR 8.04(4) and to waive fees for this program.

To offset the cost of this program, we urge EOED to find resources from funds appropriated from the General Fund for the administration of EOED programs to support these operations. We further urge the Administration to inform legislators and stakeholders if additional resources are needed to administer this program so we might advocate for increased appropriations. We urge EOED to treat applicants and the CSETF itself as last resorts when considering sources of revenue.

Align document submission deadlines with CCC application deadlines

With the launch of this new program, we urge EOED to be considerate of the fact that many applicants do no have experience with government contracting, operate with small and nimble teams, and have many, many CCC, municipal, and other government obligations and deadlines.

Given that context, it is unnecessarily burdensome for EOED to require submission of letters of good standing from the Secretary of the Commonwealth, the Department of Unemployment Assistance, and the Department of Revenue within 30 days of application when the CCC sets a 90-day requirement in their license application process.

To reduce confusion, we urge EOED to align its deadline for submitting documents with the CCC’s and amendment 400 CMR 8.04(2)(e) as follows:

”Certificates of good standing, issued within 30

Ensure outreach to diverse outlets when promoting program

We are encouraged to see that, per 400 CMR 8.04(5), EOED will advertise the program “to encourage participation from applicants representing all License types.” We’re further encouraged that by statute and per EOED staff comments, the agency will collaborate with the CCC to ensure that all eligible applicants and licensees are aware when EOED is accepting applications or issues and RFP.

However, given that this program will be open to applicants who may not have submitted an application to the CCC, we urge EOED to strengthen this regulation to emphasize that the agency will invest staff time and resources in both earned and paid marketing to media, association, and other channels that reach communities most harmed by the war on drugs.

We urge EOED to amend 400 CMR 8.04(5) as follows:

“Outreach. When issuing an RFP or when accepting applications for Financial Assistance on a rolling basis, EOED shall advertise the program to encourage participation from applicants representing all License types, including paid advertisements and earned media coverage through publications, broadcasters, newspapers, blogs, social media, associations, and other channels likely to reach a majority minority audience and other communities disparately impacted by the war on drugs.”

Data Transparency & Evaluation

It was very encouraging to hear your team discuss the fact that you will be reviewing and evaluating this initial round of grants to help inform future application processes with the CSEAB. In follow up to EON’s December 8 letter on this topic, we reiterate our recommendation that EOED codify an intentional approach to evaluation, data collection, and transparency.

We hope that you will take a systematic approach to collecting stakeholder feedback that includes user experience surveys of applicants who complete the application (including those denied, wait-listed, and approved) at and about every step of the process (instructions, submission, receipt of payment, accounting of expenses, and any other milestones). EOED may also want to consider formal or informal user experience testing with stakeholders to better understand how potential applicants find the website, what information they look for, where they look for it, and what is and isn’t working in helping them navigate the online application.

Another important aspect of evaluating the program’s impact will be robust and transparent data collection about Cannabis Social Equity Trust Fund applicants. Ch. 180 calls on EOED to “take into consideration the racial, ethnic and gender demographics of the municipality in which the recipient businesses are located.” We believe that to understand the impact of this program, EOED should publish aggregate data on the racial, ethnic, and gender demographics of applicants of all applicants with breakdowns of rejected, waitlisted, and approved applicants to start, as well as the traits of their host communities.

It would also be helpful to understand what types of licensees receive funds based on status (provisional, final, commence operations) and type (retail, delivery, cultivation, etc.), as well as the sizes of those companies (by employees and annual revenue). We hope that by systemizing data collection and transparency early on, your agency, the Cannabis Social Equity Advisory Board, and stakeholders can continuously improve on that process and the program. We urge EOED and the Cannabis Social Equity Advisory Board to further discuss how EOED can best capture applicant feedback, report back, and improve, as well as what kind of aggregate data to collect to assess the program’s impact.

Conclusion

Congratulations and thank you again on this exciting milestone. Your work will have a direct impact on helping those most harmed by the war on drugs to create economic opportunities for themselves and their communities.

We appreciate the opportunity to share this feedback, appreciate your consideration of it, and hope that it will help you create an even stronger program.

Please do not hesitate to contact us with any questions or if we can ever be a partner or resource by emailing EON Policy Co-Chair Kevin Gilnack at kevin@masseon.com.

Respectfully,

Shanel Lindsay, Co-Founder, Equitable Opportunities Now

Armani White, Policy Co-Chair, Equitable Opportunities Now

Kevin Gilnack, Policy Co-Chair, Equitable Opportunities Now

[1] “Money in the fund shall be subject to appropriation. Money in the fund shall be expended for the implementation, administration and enforcement of this chapter by the commission and by the department of agricultural resources for the implementation, administration and enforcement of sections 116 to 123, inclusive, of chapter 128 and the provision of pesticide control pursuant to chapter 132B. Thereafter, money in the fund shall be expended for: (i) public and behavioral health… (ii) public safety; (iii) municipal police training; (iv) the Prevention and Wellness Trust Fund…; and (v) programming for restorative justice, jail diversion, workforce development, industry specific technical assistance, and mentoring services for economically-disadvantaged persons in communities disproportionately impacted by high rates of arrest and incarceration for marijuana offenses pursuant to chapter 94C.” (Chapter 55 of the Acts of 2017)